Credit Wellness Insights

Hey there, savvy money maestros!

Ever wondered how; let's say Sarah, a superhero single mom, pulled her credit score up by a whopping 100 points? It's more than just numbers – it's the journey of triumph over credit chaos. In our Credit Wellness Insights, we spill the beans on real stories and toss in tips to keep your credit file as fit as a fiddle. Let's dive into the nitty-gritty of maintaining that oh-so-attractive credit file.

Understanding Credit Scores

Understanding credit scores is crucial.

Though it might feel overdone, many still underestimate the power of credit. If you don't truly understand what it takes to achieve and maintain a good credit score. Here goes your lesson.😉

Credit Score range from 300 to 850, this score reflects your creditworthiness.

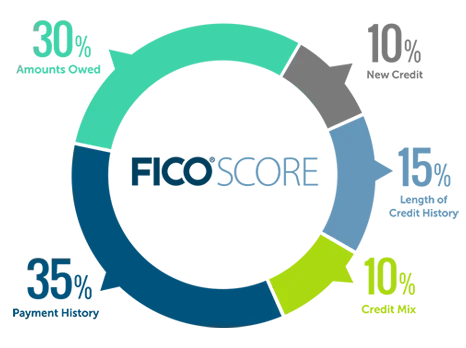

There are many different credit score models. While many credit monitoring companies provide a Vantage score, the FICO score is widely used and a more reliable model to be in the know of where your credit stands.

Now the 5 Key Factors that determine your credit score, and their influence!

1. Payment History (35%)

Payment history reflects your ability to pay on time. In the eyes of lenders and creditors, how likely you are to pay back your debts. Are you worth the risk?

Perspective: Your friend or family member asks to borrow money. If you can afford to lend the money, you make your decision based on the persons character, will you see your money again or not. When you request to borrow money from a lender they must also mitigate risk, but they can't make a decision based on your character because they don't know you. So they utilize your credit report; consider it your financial report card. If it looks appealing, they'll deem you as a creditworthy borrower and extend a loan or credit card.

Now...... 👀 If you're the "I pay all my bills on time" so my credit should be good. Let's make it clear!!!! This read is referring to your credit score and report. If it doesn't report to your credit (cell phone, rent, utilities, insurance, parking pass, subscriptions, etc.) it does not apply in this discussion.

2. Credit Utilization (30%)

Credit utilization is the ratio between your available credit and balances owed on revolving accounts only! The higher your balances are, the higher your utilization will be, and the lower your score will drop. No this doesn't mean you can't use your credit cards, you can use them how you choose, max them out if you want because there is flexibility in this factor. Just as your score decreases when your utilization increases, your score will increase as your utilization decreases.

Example: You have one credit card with a limit of $1,000. You spend $300. Now your balance is $300 and your available credit is $700. That places your utilization at 30%. Once you pay the $300 balance off, your back to 0% utilization.

Lenders favor lower utilization because they view a borrower/consumer with high utilization as high risk. It's giving broke or financially unstable, showing you rely heavily on your credit (borrowed money) to make it by or you're just financially irresponsible and live beyond your means. With that said, make sure your utilization is below 30% when you're seeking new credit. The lower the better!

3. Length of Credit History (15%)

Length of credit history is an average based on the age of your total accounts. The longer you maintain an account in open status, the more your overall credit history/age will increase. Every new account you open will lower your average age of accounts.

Lenders will favor a credit file with more age over a less seasoned credit file, even if it reflects more available credit and more accounts. Maintaining an account for a long period of time with no late payments shows financial stability. So it's good practice to keep those accounts open as long as you can.

4. Types of Credit (10%)

Types of credit is your mix of account types (revolving and installment). A mix of different types of accounts is more favorable to any lender or existing creditor. Credit cards are revolving accounts. Loans are installment accounts. The mix of accounts shows versatility and adds to the health of your credit file.

Believe it or not, even in 2024 there are still people who frown upon credit and feel it's bad news. Trust me I have many discussions with people that steer clear of credit. Unfortunately they're sleeping on an extremely viable financial tool. BUILD YOUR CREDIT! If you are afraid you'll lose control of your finances or ruin it, utilize the resources available to you. Re•invantage will get you together! Educate, Repair, Build, Leverage.

5. New Credit (10%)

New credit is any account with less than 6 to 12 months of age. Every lender or financial institution has different underwriting requirements, so what each of them determine a new account differs. It's okay to have new accounts, just keep in mind how it will impact your financial plans. If you are building your credit, obviously you will have a few new accounts, but if you're seeking funding of some sort, it could backfire on your approval odds and the amount you're approved for. Oh and don't forget, those hard inquiries that come along with new accounts. Too many hard inquiries is a telltale of a credit seeking borrower/consumer. Think about it, 5 new hard inquires with no new accounts means you either didn't accept the offers or the lenders denied your applications. So why would any other lender take the risk... or 5 new hard inquiries and 3 new accounts, why is this borrower wanting so many credit cards or loans.... 🤔 Looks risky "DECLINE". Be strategic through your journey to win the game.

Knowledge is power. You don't know what you don't know. -The Dunning Kruger Effect

Everyone should be in the know when it comes to their credit. Checking your credit file has no negative impact on your credit score. Review your credit reports frequently to catch any errors, inaccuracies, and fraudulent information. Fraud and identity theft is at an all time high, and in this digital world we are all susceptible to having our personal information leaked.

Re•invantage is a resource to financial empowerment, we're here to assist when you're ready!

Office: 6595 Roswell Rd Ste G1920, Atlanta GA 30328

Call: +1 470-888-8760

Email: info@reinvantage.com